Hello, everybody! Call your sweater in Birmingham, Alabama. I hope everybody's having an awesome day. I wanted to touch base with everybody about closing attorneys and who selects them, as well as who selects the title insurance and that sort of thing under Alabama's state law. There is a real issue here in Birmingham. There has been this myth for all these years that the seller decides who picks the closing attorney, but that couldn't be farther from any codified law of any kind. It's not in any document. If you know of any, please let me know. There are a lot of Realtors, particularly with Realty South, who also have a title company, and those guys are always adamant about using Title South because it's their own. But, I always ask, can you show me where it says that the seller chooses the attorney? Because everybody's got to remember that the closing attorney represents the bank, the lender in the transaction. And as such, the lender ultimately can decide who closes the transaction. Both sides are able to have their own representation if they'd like. It happens rarely, but they're allowed to have their own attorneys present at the closing and review all the documents. But ultimately, the lender is the one being represented. You probably have signed documents like that, but a lot of times, agents obviously want to help out their service providers, their closing attorneys, because they know and trust them. But what I think these Birmingham real estate agents have got to understand is that almost everywhere else in the state of Alabama, the buyer chooses who represents them. Let's talk about why that is. If you really were to look at the closest next solo closest connection from that lender to the transaction, it's through the buyer....

Award-winning PDF software

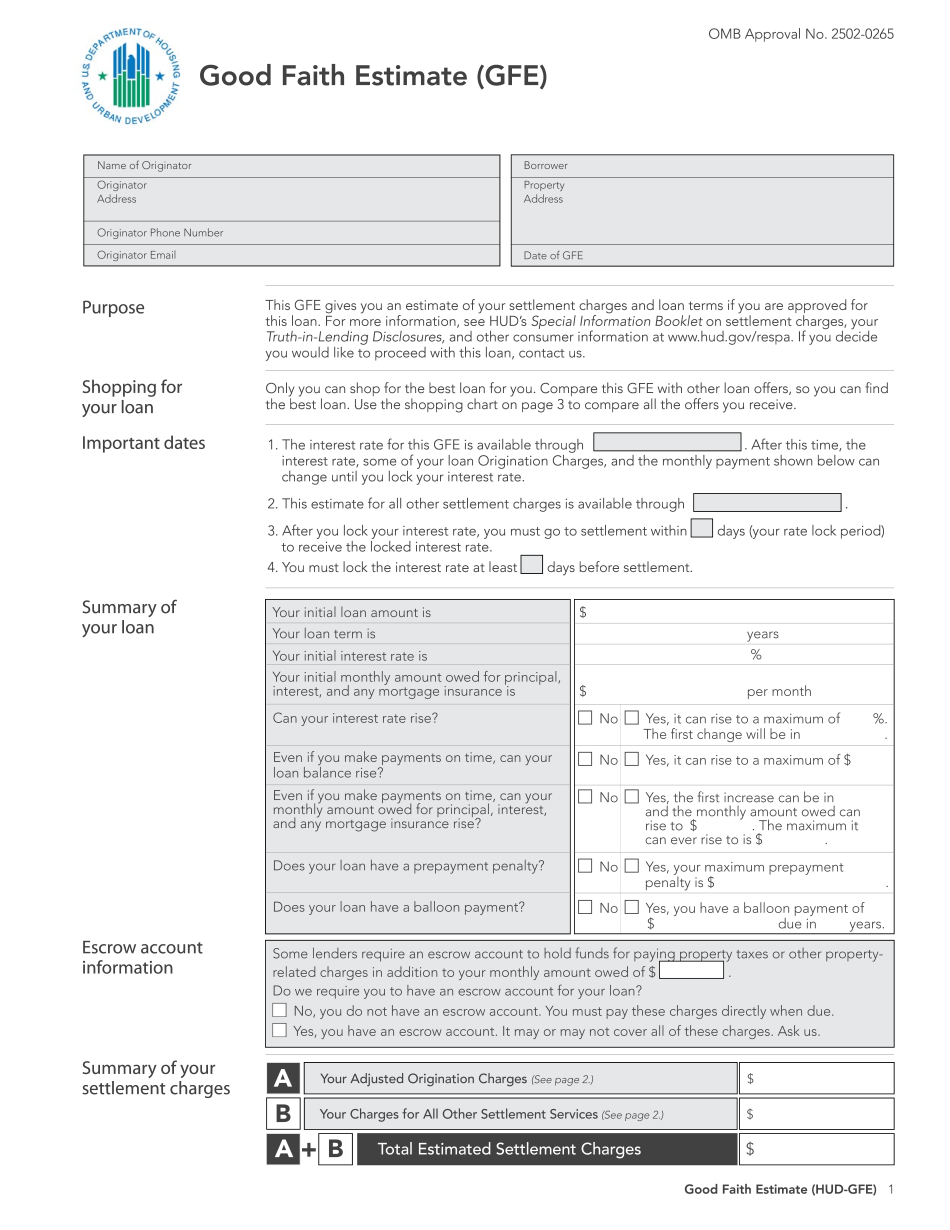

Respa section 9 Form: What You Should Know

RESP — GFE Form Section 9 of RESP also prohibits a seller from requiring one or more federal-backed lenders to purchase title insurance from that same seller. RESP — GFE Form Section 9 of RESP also prohibits a seller from requiring a seller to have one or more federal-backed lenders purchase title insurance from that same seller. RESP — GFE Form Section 9 of RESP also prohibits a seller from requiring a seller to have one or more federal-backed lenders purchase title insurance from that same seller. RESP — GFE Form Section 9 of RESP prohibits a seller from refusing to make payment or closing on a seller's property in which there is an open and unfulfilled CFPB Consumer Laws and Regulations RESP If Section 9 of RES prohibits the use of Title Insurance, a seller cannot impose a different rule for each buyer. RESP — GFE Form Section 9 of RESP prohibits a seller from requiring a seller's lenders to make payment on a seller's property, unless the buyers can show that they RESP — GFE Form RESP Section 9 has an exception that allows a seller to require title insurance for a specific amount. RESP — GFE Form Permits sellers to impose a different rule for each buyer. RESP — GFE Form The seller is not required to have a specific amount of Title Insurance, but is permitted to require the loan originator to have Title Insurance, if the RESP — GFE Form Title Insurance is provided by a seller or an “issuer.” RESP — GFE Form Title Insurance by a seller is required for each loan. RESP — GFE Form Refusal to make a loan with Title Insurance that exceeds the amount specified in the seller's GFE will cause the loan to be rejected by the RESP — GFE Form Fees for Title Insurance provided by seller will only be assessed when the seller requires a seller's lenders to pay a percentage, not an RESP — GFE Form percentage of their loans at time of closing. RESP — GFE Form Title Insurance is also mandatory for a mortgage loan where any loan amount specified in the Seller's GFE or the loan terms RESP — GFE Form has more than 1,000,000 in total amounts of principal and interest.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-Gfe, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-Gfe Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-Gfe by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-Gfe from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Respa section 9