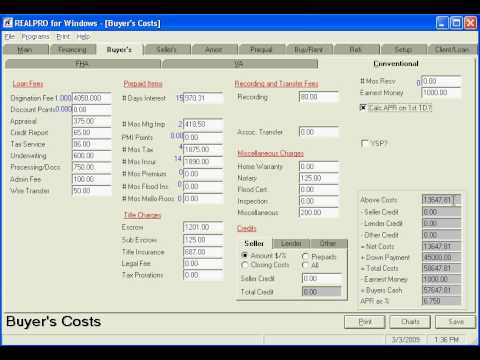

This is going to be a conventional financing and buyer's cost tutorial. This time, I'm going to show you the Good Faith estimate. Some of you have been using it, and some don't even know that it's in here, so it might be a good thing to take a look at. Let me go to financing conventional. Say the sales price is $450,000. Go over here to the interest rate, 5.75%. Enter, enter, enter. Down payment of ten percent gives us a new first trust deed of $405,000. It's your payment property insurance, 1.3% which means $135. Property tax and mortgage insurance based on 0.62% giving us a payment of $3,176.48. Go right from here to your buyer's closing costs. So your one point origination, let's say there's zero for the discount points. Appraisal credit report tax service underwriting and you would change these numbers to match your needs. Thirty days of interest, if you like 15, go ahead and change it. Do taxes, let's say we want four months. Fourteen months insurance, your escrow sub-escrow change it as you need. Now I'm going to say $125 for notary. The seller is not going to assist with any of the closing costs, but we're going to have a $1,000 in earnest money. And we're going to calculate the APR on the first above cost. $13,647 plus a down payment gives your total costs minus the earnest money gives your cash to close and your APR. If we go to charts, go to a Good Faith estimate, fill out this information here. Your name, lender address, city, state, and zip. Your client's information and a loan number. Put in a loan number and say okay. And this is what the Good Faith estimate will look like. I will print this, I...

Award-winning PDF software

Is a good faith ebinding Form: What You Should Know

Use the Good Faith Estimate (GFE) — Fannie Mae The Good Faith Estimate (GFE) of your down payment is only required if you are approved for a reverse mortgage loan. Good Faith Estimate and Mortgage Lenders Feb 18, 2024 — Mortgage brokers can get a good faith estimate. If you would like other advice, refer this article to a licensed banker. Good Faith Estimates — Mortgage and Mortgage Companies Aug 3, 2024 — Good faith estimates are for “buyers” only. You do not need a good faith estimate to get a loan. This is good for those who will be buying a property. Your own home cannot give you a good faith estimate. Homes That May Get You a Good Faith Estimate (GFE) April 2, 2024 — There are several ways to get good faith estimates: 1. Use the “Ask Me to estimate” tool on my blog. If you are interested in getting a loan, you should ask this kind of questions; it will only take about 15 minutes. You'll never see a low-ball interest rate or a rate that is above 30%. 2. Contact a Lending Club. They will ask you questions at the time the loan is approved, and they will give you a mortgage estimate as a first step: (The same is also true with your mortgage broker or mortgage loan officer.) 3. I highly recommend you have someone who can get a good faith estimate for you by providing you with accurate information through my e-mail account, as well as posting your questions on my blog. Good Faith Estimate Definition — HUD To get the best fair and honest interest on a mortgage, the government mandates that you use a qualified person to calculate a good faith estimate. That means that you can only trust how the person will arrive at the best possible interest rate. It also means you may have to pay an extra fee, as it costs your lender more to have a “qualified person” estimate a home loan. Good faith estimates and the Federal Housing Administration (FHA) The FHA's mortgage policy states: “You have a Good Faith Estimate if you use a person or firm that knows the information you are given and that is willing to make a reasonable effort to arrive at an accurate estimate” So, to get a “good faith estimate” the FHA has to take that into consideration when determining your rate.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-Gfe, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-Gfe Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-Gfe by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-Gfe from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Is a good faith ebinding