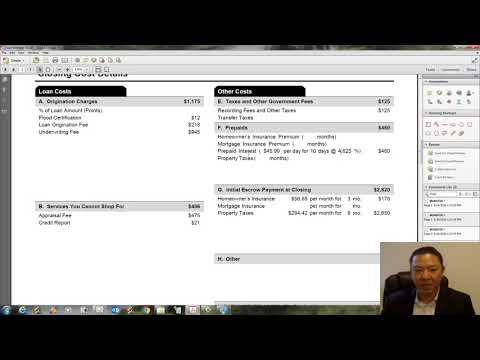

As you went with the home loan source, today I wanted to go over the loan and show you how to read a loan. Okay, alright, so you can see my cursor over here. The loan, and this is pretty much when you're applying for a home loan, they're going to prepare for you a quote, and it's going to be called the other loan. The date issued is the day that they issue it, and then the applicant's name should be your name, and the property address and the estimated property value. If you want to know your property value, real estate agents and loan officers can prepare what's called a competitive market analysis, which is the CMA. So, if you're wanting a CMA, go ahead and send me an email, send me a message on the website, or you can call me and set an appointment with me, and I could run a comparative market analysis for you. Okay, if you want to know the value of your property. So, this right here is the loan term. It's going to be either 30-year fixed, 25, 20, 15, 10, or it might be an ARM. So, the purpose here is going to be to refinance, purchase, or a cash out. And then this is the loan type, either conventional, FHA, VA, FHA, and then VA. And then this is the rate lock. If your loan is locked or not, so the rate lock is once you commit to a loan, you lock it in for 30 days, and you typically have 30 days. But remember that we have two weekends, so out of 30 days you have 8 days that are weekends. So, you really have about 22 days. So, if your loan officer asks you for documents, go ahead...

Award-winning PDF software

How accurate is loan estimate Form: What You Should Know

How to Read Your Loan Estimate (with Details) The Loan Estimate provides several pages of information. This post walks you though every detail, including whether the loan is for a “starter”, “substitute” or “specialty” loan (which you should know). Loan Offer Definition (with Examples) How can I choose the best mortgage for my needs? This post shows you how to find out by reviewing different types of mortgages, with examples. A Loan Estimate Explainer — How to Read a Home Loan Offers Each loan offers a specific breakdown. The information provided in the Loan Estimate includes the following: a description of the loan; the maximum payments; the annual interest rate and the payment amount; and a list of property and purchase information. What is a “starter loan”? How can I use a mortgage calculator to figure out the best amount to borrow? This post provides a few ways to do it. Loan Offer Definitive Information and What to Look For The details given in the loan offer may be important to you. But, they aren't always a good fit for your needs. Learn how to determine what is a good match and avoid “pay the wrong amount” scams! The Loan Estimate Explainer — How to Read a Mortgage Offers (with Examples) A loan estimate is a useful tool for showing you both good and bad options. The following post shows you how to use it to look at the benefits and risks of different lenders and how to read the Loan Estimate to ensure it reflects the loan options Loan Offer Definition: The Details That Makers Learn The details given in a loan offer may be important to you. How often can you expect to be contacted? When you may qualify for the financing, and what are the terms? You may need to understand the details of a loan offer to understand what kind of deals to offer. The Loan Estimate Explainer — How to Read a Lender's Loafers Lender offers are often difficult to analyze. And, that's because they give many terms and costs, even though they appear similar, even when the terms change. How can I use a Loan Estimate to see if there is more to a deal than meets the eye? The information provided in your Loan Estimate may be accurate.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-Gfe, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-Gfe Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-Gfe by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-Gfe from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How accurate is loan estimate