Hi GP, there is a mistake in the first sentence. It should be "Hi GP, with Varitek's Mortgage, it's important to know exactly what is on your Good Faith Estimate." The next sentence should be "In this video, it will explain it in more detail." The sentence "A Good Faith should usually be provided up front by the mortgage banker" should be "A Good Faith Estimate should usually be provided upfront by the mortgage banker." The sentence "A Good Faith is going to pryou with an eof the fees for that transaction" should be "A Good Faith Estimate is going to provide you with an estimate of the fees for that transaction." The sentence "A Good Faith is something that when you're comparing rates from one bank to another certainly something that you want to factor in what the closing costs are going to be" should be "A Good Faith Estimate is something that you want to factor in when you're comparing rates from one bank to another, especially the closing costs." The sentence "you know what the title insurance what the title fees any kind of recording fees as we update your tax and insurance information" should be "You'll also know about the title insurance, title fees, recording fees, and any updates to your tax and insurance information." Lastly, the sentence "so you can compare the two Good Faith Estimates and make sure you know there's no hidden fees or surprises at the end of the transaction so that's the main thing that the Good Faith provides just a sense of security and protection for the homeowner you" should be "So, you can compare the two Good Faith Estimates and make sure there are no hidden fees or surprises at the end of the transaction. That's the main thing...

Award-winning PDF software

Good faith edefinition Form: What You Should Know

Good Faith Defined — Law Dictionary “Good” has generally been defined as the ideal or “best” by which human beings have traditionally regarded themselves, their property and their relations. Good has generally carried with it both a moral and an aesthetic aspect because people have used good as a moral principle in defining what is or should be good, and what is “right” or “just” or “good.” Good is a concept closely associated with the idea of right or morality. A key feature of the concept may be that a reasonable person would act on that assumption. Thus, it seems that if something was considered a good to a person then it was also acceptable for another person to act under that same belief, albeit in his or her own interests and not necessarily in one's own. This concept is particularly relevant in the development of the modern ethical movement, the “moral majority.” So where does this leave us? Does Good mean good? What will good mean when applied to business? What is the difference between good faith and good faith? Will it matter what type of business one is running? Will good mean good in every instance? When it comes to business, is our intention to make a profit good or just or honest? What if my intention is good for my clients, my employees, and my business? How likely is it that I might be able to make good business decisions because I am honest with myself and others? With all the uncertainty and unpredictability in the business world, how should we determine whether we are being honest or not? Good Example — Business Cards A very common situation where one would encounter Good or Honest intentions is on business cards. These cards are very common in business. The business cards of each of us are a common aspect of our lives. A good example of this would be an office card with the name and office address of the company and the main business contact person. The person's photograph is also included. In this particular example, the business card would contain truthful and honest information. This example has been given for informational purposes only. It has not been proven nor is it meant to be relied upon as legal advice. No attorney-client relationship has been established, unless otherwise expressly negotiated between you and your attorney as part of your representation. I do not have a client relationship with my readers.

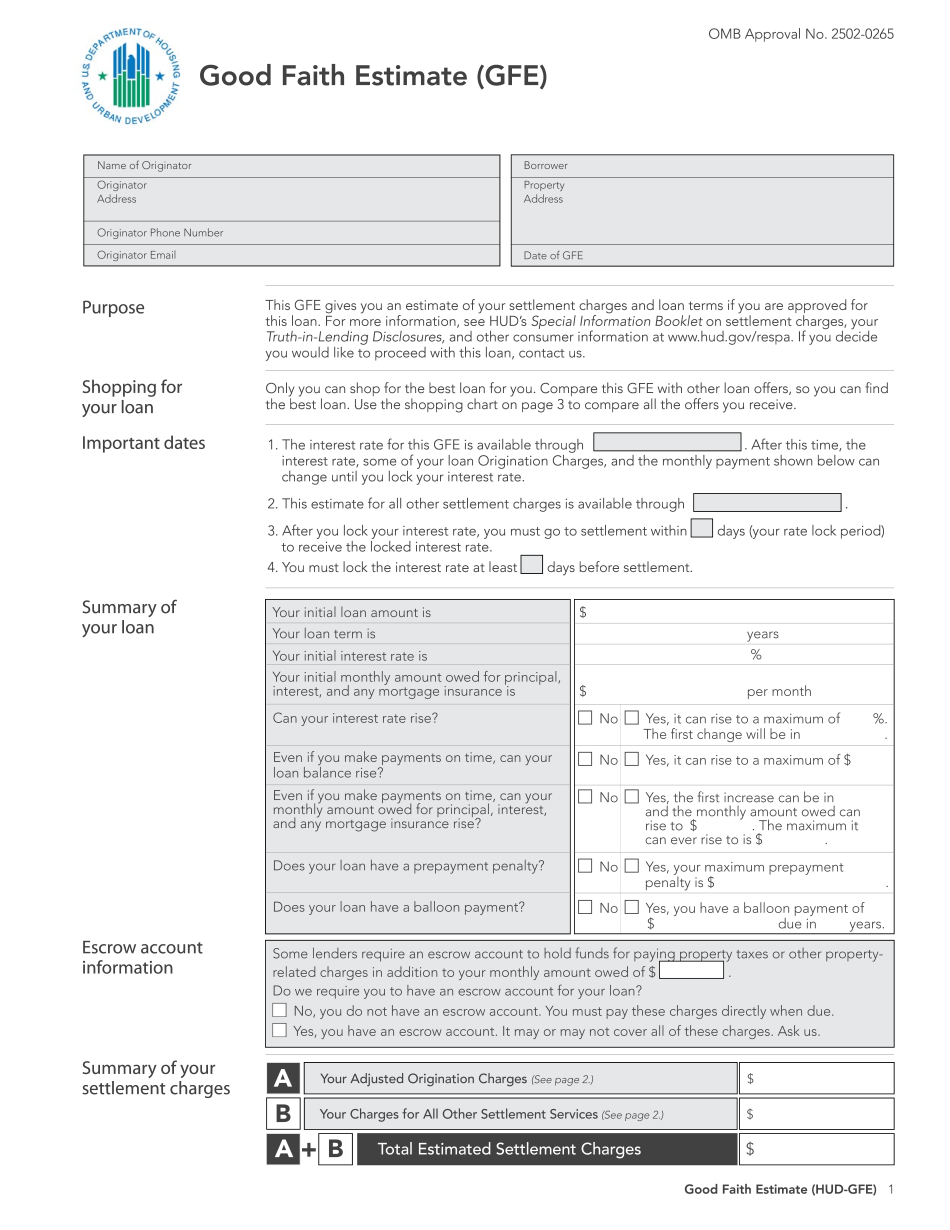

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-Gfe, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-Gfe Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-Gfe by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-Gfe from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Good faith edefinition