So, the first one I want to start talking about is Rest by Rest. For a few things, I want you to know about RESPA. Again, Restful Cells stands for the Real Estate Settlement Procedures Act (RESPA). RESPA deals with wonderful unit residential property. Another name that they may use for residential property is owner-occupied property. Don't get it wrong because they said "owner-occupied" instead of residential property. Wonderful unit residential property, the owner has to stay in one. It's okay that it's a duplex or fourplex as long as the owner stays in one, then they're governed by RESPA. You'll notice that everything on this test has to do with residential property. They don't care about investment properties, if it's more than four or any of that. This is because people were losing their homes. This is about homeowners, okay? Rest windows were wonderful unit residential properties. RESPA allows the residents or settlement services, anything having to do with settlement services, things needed to close escrow, it's going to be under RESPA. Now, the purpose of RESPA is to help consumers become better shoppers for settlement services. To show them all of their options when it comes to settlement services. It is also going to deal with things like kickback referral fees, things of that nature that we'll be talking about shortly. There are four sections of RESPA that you need to be concerned with. There are several sections of the rest of the law, but for the exam and for the CFPB, there are four sections that they specifically want to make sure you understand, and that's section six, eight, nine, and ten. They skip section seven for whatever reasons, but these are the sections that you're going to be responsible for making sure that you have information...

Award-winning PDF software

Respa Form: What You Should Know

REINSURER RESP — RESP Consumer Law “the form is an appropriate tool to provide the public in this area with information about the costs involved in the transaction.” REINSURER RESP — RESP Lending “RESP is particularly useful to consumers because it allows them to better understand the complexity of the closed end transaction.” REINSURER RESP — RESP Real Estate Settlement Procedures Act RESP and CFPB Rules Related to FHA Loans RESP and CFPB Rules Related to RMBS Loans RESP — HUD-1 Real Estate Settlement Procedures Act RESP — HUD-1 Mortgage Origination and Servicing RESP — HUD-1 Home Loan Servicing RESP — HUD-1 Loan Servicing Guidance Letter for Mortgage Origination RESP— HUD-1 Mortgage Servicing Guidance Letter for Repurchase Arrangements RESP — HUD-1 Mortgage Servicing Guidance Letter for Closed End Transactions RESP — Real Property Settlement Procedures Act — Guidance Letter for Closed End, “The CFPB's Office of Fair Lending enforces the Real Estate Settlement Procedures Act and other requirements adopted by the Federal Housing Finance Agency.

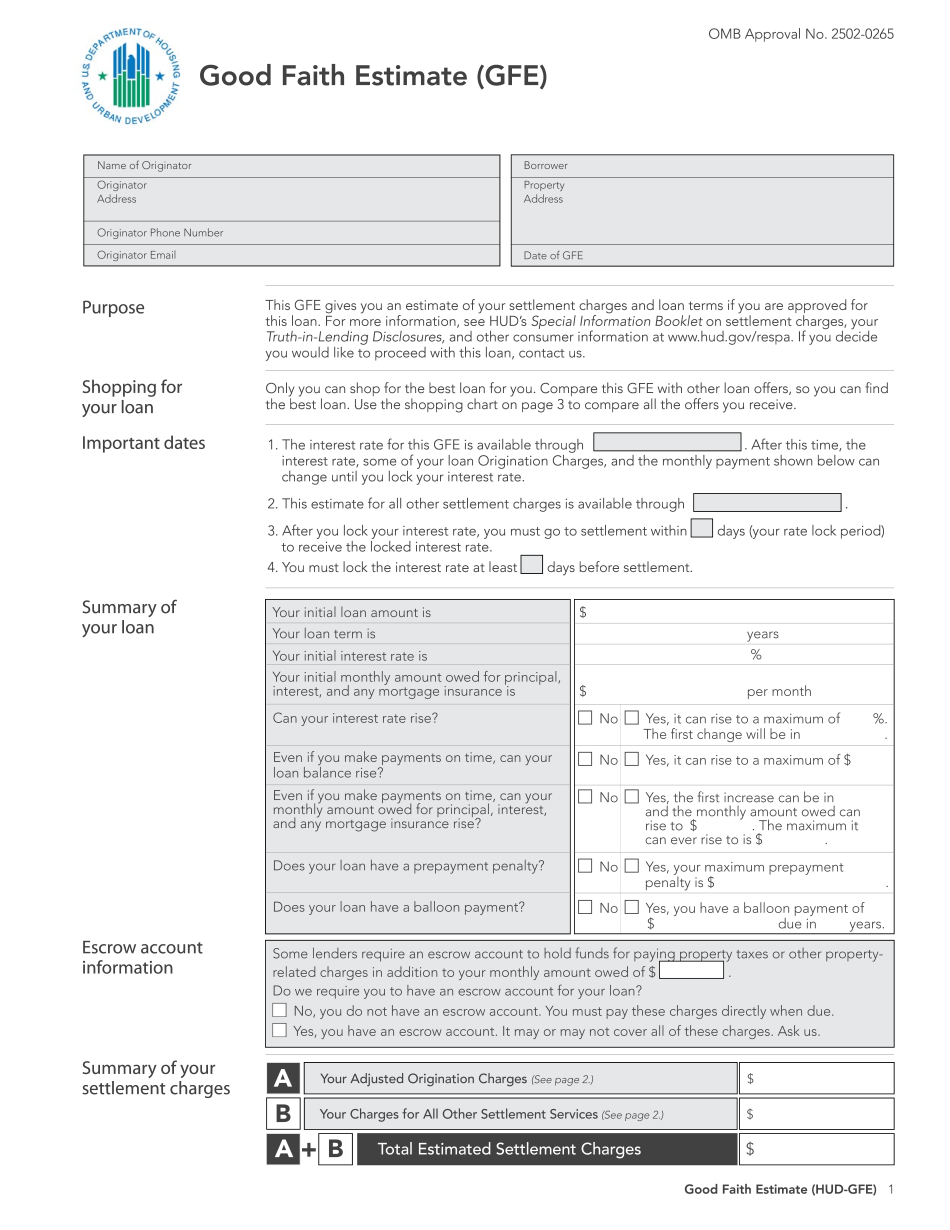

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-Gfe, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-Gfe Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-Gfe by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-Gfe from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Respa