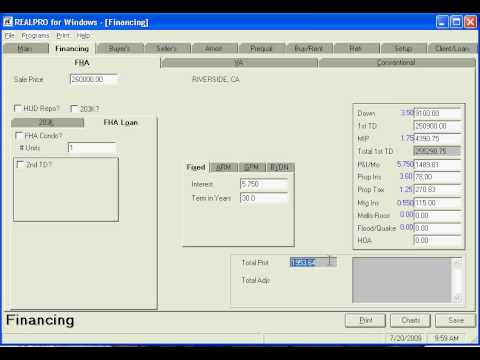

Good morning, this is Marianne, and I'm with Real Pro Innovations. I'm going to update my FHA financing and buyers cost video, so we have the most current information and the most current ideas on how to use it to benefit your clients. This is a Real Pro for Windows program, and of course, it does every other kind of loan: FHA, VA, conventional buyers, and sellers cost. But today's sample is going to be about the FHA. So, we're going to click on financing, I'm going to go to FHA, and put in our sales price. Let's say this example is going to be $260,000. It's not a 203k, but you can do a 203k loan with this; that'll be another video. And let's say today's interest rate is five and a half, which I'm showing right here. The down payment is 3.5%, and that's $9,100, bringing you to the first trust deed right here of $255,900. All FHA loans have MIP, and that's based on 1.75, so no matter what the loan-to-value is, all FHA loans have upfront MIP added to the loan, taking you to the first trust deed: the total first trust deed, which is $255,290. The payment at five and a half percent, you can see right here, is $1,449.51. In this market, people kind of get hung up on interest rates. I don't, you know. That used to be five percent; now it's five and a half. I wish I would have bought back then, or I'm afraid it's going to go to 5.75. In order to very quickly and easily show your client that the difference between the payments is not that great, is to simply change the interest rate. We go back here, make it 5.25. Remember, at 5.5, it's $1,449. At...

Award-winning PDF software

Good faith ecalculator Form: What You Should Know

How to Create a Good Faith Estimate — Budget Estimate For Mortgage Jan 9, 2024 — Creating a good faith estimate is a great guide for determining the estimate of costs, and it has the ability to fill in the estimated cost in the How to Create a Good Faith Estimate of Health Care Items and Services — CMS This Good Faith Estimate shows the costs of items and services that are reasonably expected for your health care needs. The estimate is Sample Good Faith Estimate of Closings Costs — HSH.com This is an article which discusses and displays the new and old versions of the Good Faith Estimate of Closings Costs. In some cases the closing costs may differ from the How to Create a Good Faith Estimate of HSA Account Payments — CMS This guide is to help you create a good faith estimate of HSA account payments for health care item and services. CMS has released a number of estimates for How to Create a Good Faith Estimate of Income Taxes — CMS This guide will show you how different types of income tax can be used to create a good faith estimate of taxes that are being paid by your health care providers. How to Create a Good Faith Estimate of Income Tax — IRS This guidance paper from the IRS outlines three criteria of how to determine your good faith estimate: 1). The type and amount of tax that has been paid; 2). The number of individual tax entities used to calculate the item or service; and 3) the type of income tax liability that is being used to provide the estimate. Good faith Estimate for Personal Income Taxes — IRS Good faith Estimate of Income Taxes The IRS requires individuals to report two types of itemized deductions: a) the total amount of taxable income that you earned or incurred, and b) the portion of taxable income that can be deducted from your income (deductible).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do HUD-Gfe, steer clear of blunders along with furnish it in a timely manner:

How to complete any HUD-Gfe Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your HUD-Gfe by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your HUD-Gfe from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Good faith ecalculator